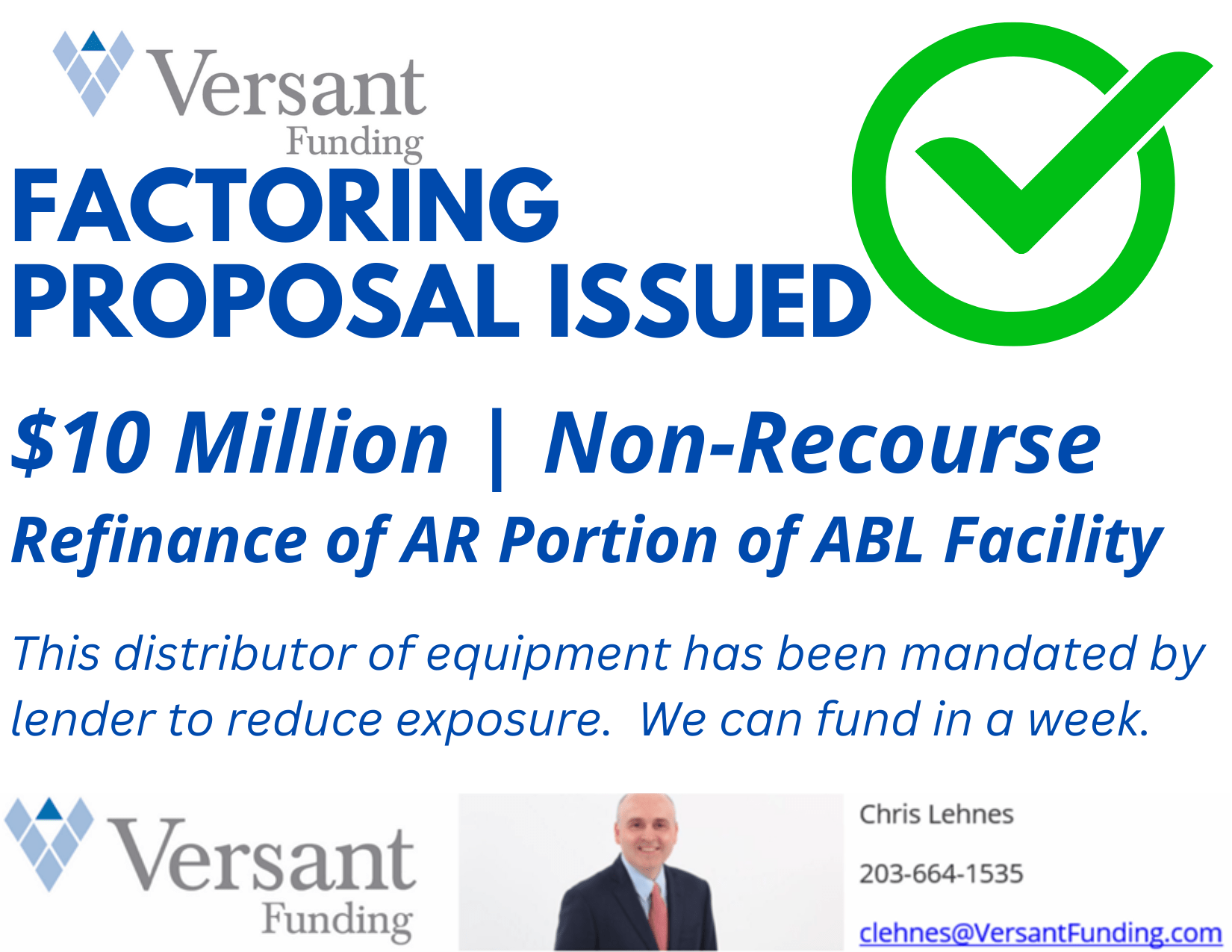

Proposal Issued – $10 Million Non-Recourse – Refinance – Distributor

This distributor of equipment has been mandated by lender to reduce exposure. We can fund in a week.

Accounts Receivable Factoring

$100,000 to $30 Million

Quick AR Advances

No Long-Term Commitment

Non-recourse

Funding in about a week

We are a great match for businesses with traits such as:

Less than 2 years old

Negative Net Worth

Losses

Customer Concentrations

Weak Credit

Character Issues

Chris Lehnes | Factoring Specialist | 203-664-1535 | chris@chrislehnes.com