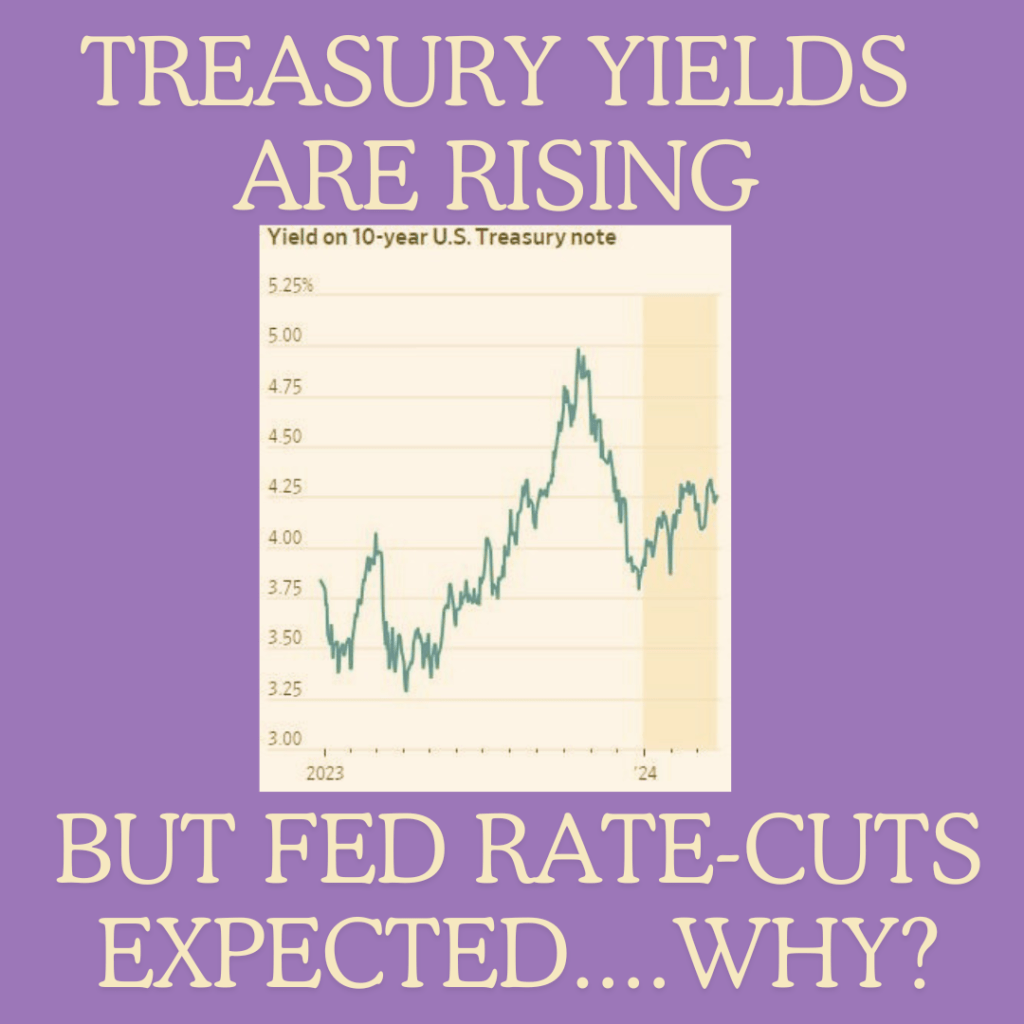

Understanding Rising Treasury Yields Amidst Expected Fed Rate Cuts

In the intricate dance of financial markets, certain phenomena can sometimes seem counterintuitive. One such puzzle currently perplexing investors is the simultaneous rise in Treasury yields alongside expectations of interest rate cuts by the Federal Reserve. While conventional wisdom might suggest that falling interest rates would naturally lead to lower yields on government bonds, the reality is often more nuanced. In this article, we delve into the factors driving this divergence and explore its implications for investors and the broader economy.

1. The Role of Market Expectations

At the heart of this conundrum lies the delicate interplay between market expectations and economic fundamentals. When investors anticipate a future reduction in interest rates by the Federal Reserve, they adjust their investment strategies accordingly. This can manifest in increased demand for Treasury securities, particularly longer-dated bonds, as investors seek to lock in higher yields before rates potentially decline further. Consequently, this surge in demand exerts upward pressure on bond prices and drives yields lower.

2. Inflationary Concerns

However, the picture becomes more complex when inflationary pressures enter the equation. Inflation erodes the real value of fixed-income investments such as bonds, leading investors to demand higher yields as compensation for the diminished purchasing power of future cash flows. In recent times, mounting concerns about inflation, fueled by supply chain disruptions, robust consumer demand, and fiscal stimulus measures, have contributed to upward pressure on Treasury yields.

3. Economic Growth Expectations

Moreover, rising Treasury yields can also reflect optimism about the economic outlook. When investors anticipate robust economic growth, they often rotate out of safe-haven assets like government bonds and into riskier investments such as equities. This shift in sentiment can drive up Treasury yields as bond prices fall in response to reduced demand. Hence, the prospect of Fed rate cuts may be outweighed by bullish sentiment regarding the broader economic landscape, prompting investors to demand higher yields on Treasury securities.

4. Yield Curve Dynamics

Another crucial aspect to consider is the shape of the yield curve. In a normal economic environment, longer-dated Treasury yields are higher than shorter-dated ones to compensate investors for the increased risk associated with holding bonds over a more extended period. However, when short-term interest rates are expected to decline, the yield curve may flatten or even invert as investors anticipate a slowing economy and lower future returns. In such scenarios, longer-dated Treasury yields could rise despite expectations of Fed rate cuts.

Implications for Investors and the Economy

For investors, navigating this environment requires a nuanced understanding of the interplay between monetary policy, inflation dynamics, and economic fundamentals. While rising Treasury yields may present opportunities for those seeking higher returns, they also entail heightened risks, particularly in a potentially inflationary environment.

From a broader economic perspective, the divergence between rising Treasury yields and anticipated Fed rate cuts underscores the complexity of policymaking in an uncertain environment. The Federal Reserve must carefully balance its dual mandate of promoting maximum employment and stable prices while responding to evolving market conditions.

In conclusion, the current phenomenon of rising Treasury yields amidst expectations of Fed rate cuts underscores the multifaceted nature of financial markets. Investors and policymakers alike must remain vigilant in assessing the myriad factors driving market dynamics and their implications for the economy at large. By staying informed and adaptable, stakeholders can navigate this challenging landscape with greater confidence and resilience.