Factoring Proposal: With only a single major distributor as customer, this business was unable to find a lender willing to fund them. Our underwriting focuses solely on the quality of our client’s customer so time in business and customer concentration are irrelevant.

In the world of candy importing, timing is everything. You have to navigate seasonal peaks (think Halloween and Valentine’s Day), manage international shipping lead times, and juggle the demands of large retailers.

However, there is often a massive gap between the moment your colorful shipments clear customs and the moment your retail partners actually pay their invoices. If your capital is trapped in Accounts Receivable (AR), you might find yourself unable to jump on the next big inventory opportunity.

This is where Accounts Receivable Factoring—also known as invoice factoring—becomes a game-changer.

What Exactly is Factoring?

Factoring isn’t a loan; it’s the sale of your assets. You sell your outstanding invoices to a “factor” (a specialized financial company) at a slight discount. In return, you get immediate access to the cash that was previously tied up for 30, 60, or even 90 days.

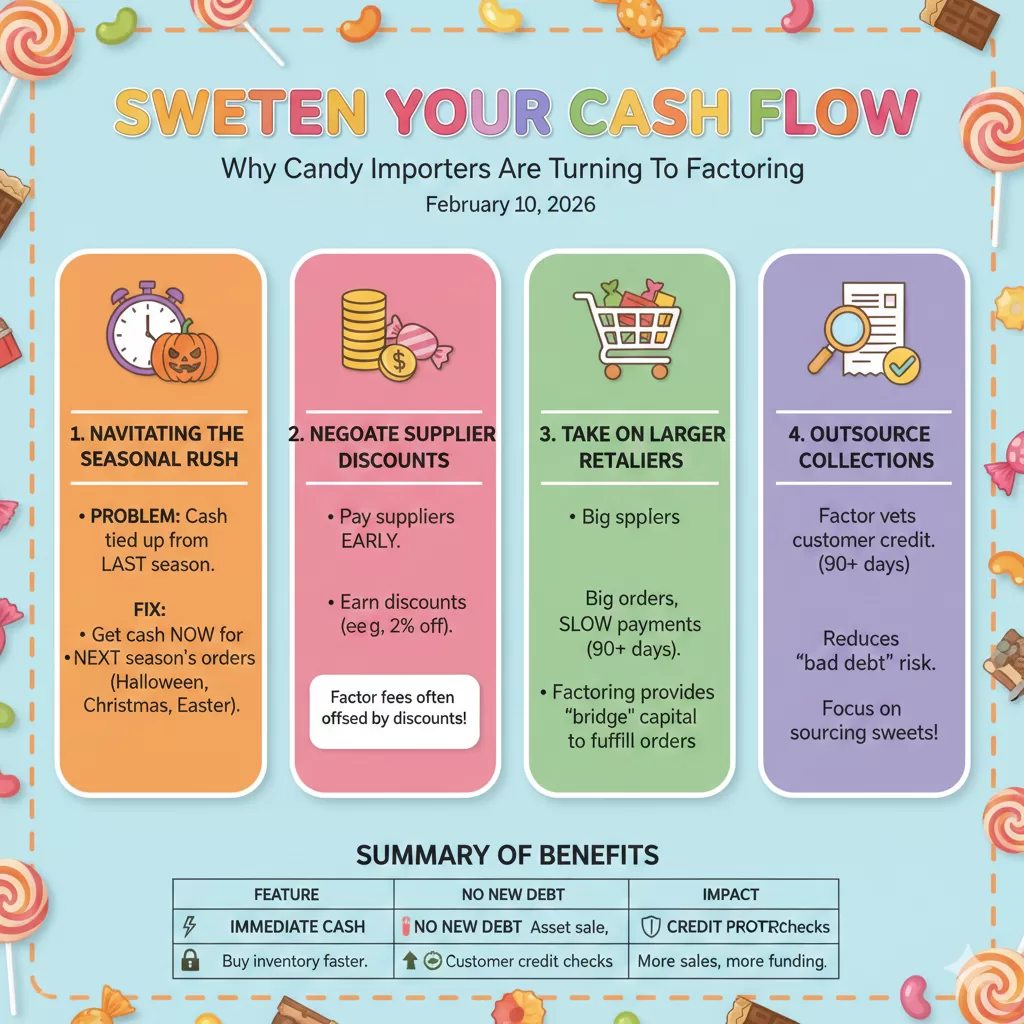

1. Navigating the Seasonal Rush

Candy is a highly seasonal business. To prepare for the “Big Three”—Halloween, Christmas, and Easter—importers must place massive orders months in advance.

- The Problem: Your cash is tied up in invoices from the previous season while you need to pay suppliers for the next one.

- The Factoring Fix: By factoring current invoices, you get an immediate cash injection to cover manufacturing and shipping costs for upcoming peak periods, ensuring you never miss a shelf-stocking deadline.

2. Negotiating Supplier Discounts

When you have “cash in hand” thanks to factoring, you move to the front of the line with global suppliers. Many international manufacturers offer early payment discounts (e.g., a 2% discount if paid within 10 days).

- The small fee you pay for factoring is often completely offset by the discounts you earn from your suppliers by paying them early.

3. Taking on Larger Retailers

Big-box retailers are great for volume, but they are notorious for long payment terms. If a major chain wants to place a massive order but won’t pay for 90 days, a small-to-medium importer might have to say “no” simply because they can’t afford to wait that long for the payout.

- Factoring provides the “bridge” capital. You can fulfill the order, factor the invoice the day the candy ships, and have the funds to keep the rest of your business running smoothly.

4. Outsourcing the “Headache” of Collections

Many factoring companies handle the back-end credit checking and collections process. For a lean importing team, this is a massive relief.

- The factor vets the creditworthiness of your customers before you even ship, reducing your risk of “bad debt” and allowing you to focus on sourcing the best sweets rather than chasing down checks.

Summary of Benefits

| Feature | Impact on Your Candy Business |

| Immediate Cash | Buy inventory for the next holiday season without waiting. |

| No New Debt | Factoring is an asset sale, not a bank loan with monthly interest. |

| Credit Protection | Many factors provide credit snapshots of your retail partners. |

| Scalability | The more you sell, the more funding becomes available. |

Is Factoring Right for You?

If your candy importing business is growing faster than your bank account can keep up with, factoring provides the liquidity to keep your momentum. It turns your “sold” inventory back into “buying” power instantly.

Contact Factoring Specialist, Chris Lehnes