In recent months, fast food aficionados have been greeted with an unwelcome surprise: their favorite quick bites are becoming increasingly expensive. The once-affordable indulgence of a fast food meal is now putting a dent in wallets across the board. This phenomenon begs the question: why are fast food prices on the rise?

Supply Chain Woes

One of the primary culprits behind the surge in fast food prices is the ongoing disruption in supply chains. From farm to table, the journey of ingredients to your favorite fast food joint involves a complex network of suppliers, distributors, and manufacturers. However, disruptions like extreme weather events, labor shortages, and transportation challenges have thrown a wrench into this intricate system.

Consider the impact of climate change on agriculture. Unpredictable weather patterns and natural disasters can decimate crops, leading to shortages and increased prices for key ingredients like wheat, corn, and potatoes – staples in many fast food offerings. Furthermore, labor shortages exacerbated by the COVID-19 pandemic have led to increased wages for workers throughout the supply chain, which in turn drive up production costs.

Inflationary Pressures

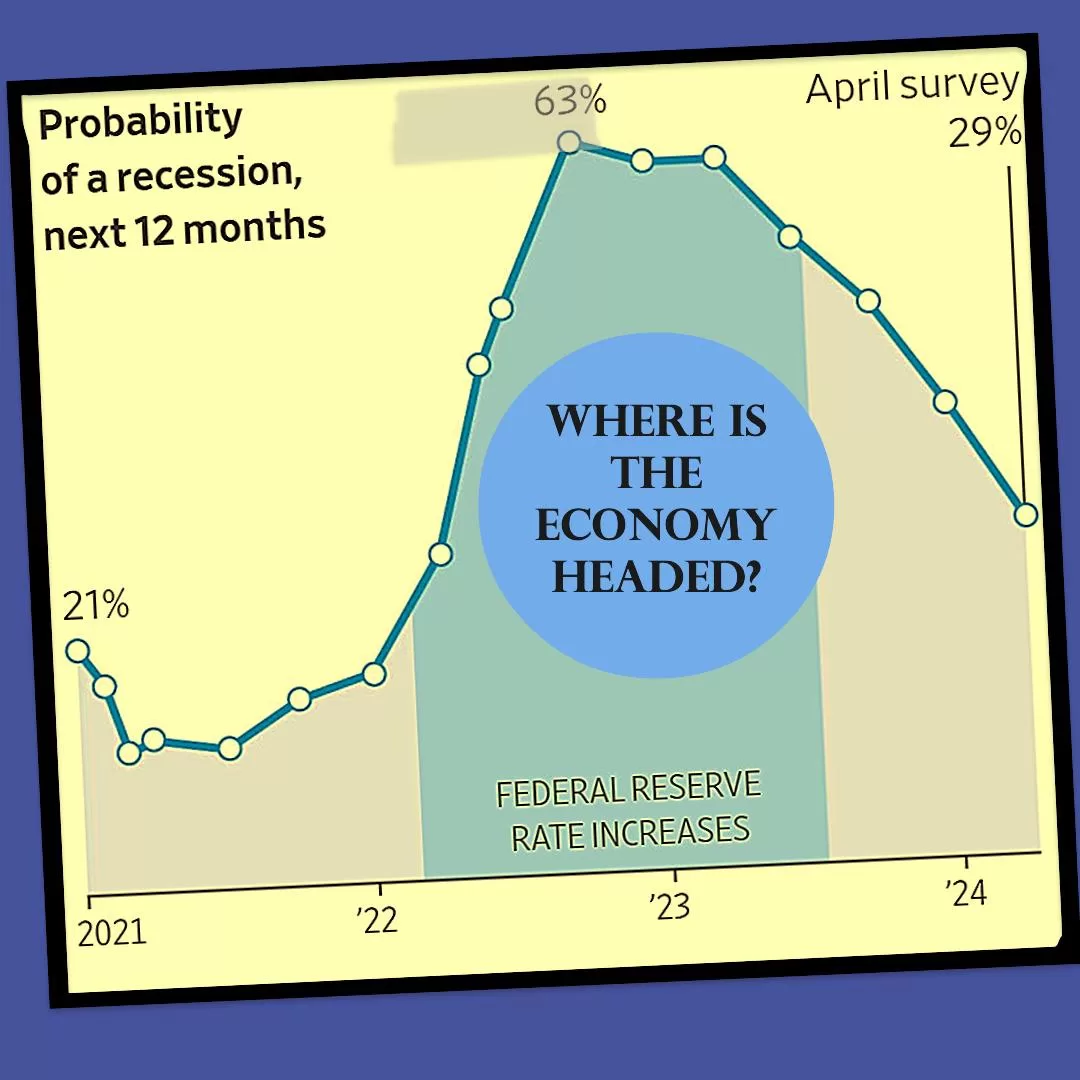

Inflation, the general increase in prices over time, is another factor contributing to the uptick in fast food prices. As the cost of living rises, businesses are forced to adjust their prices to maintain profitability. The Federal Reserve’s efforts to stimulate the economy through low interest rates and monetary stimulus measures can inadvertently fuel inflationary pressures, further squeezing the margins of fast food establishments.

Menu Evolution

Another factor influencing fast food prices is the evolving nature of menus. In response to changing consumer preferences and societal trends, many fast food chains have expanded their offerings to include healthier, more sustainable options. While these menu additions may appeal to a broader customer base, they often come with higher price tags due to the use of premium ingredients and additional preparation requirements.

Navigating the New Normal

As consumers grapple with the reality of higher fast food prices, many are forced to reconsider their dining habits. Some may opt for less frequent visits to their favorite chains, while others may explore alternative dining options such as home-cooked meals or locally sourced eateries. Additionally, loyalty programs and promotional deals may become increasingly valuable as consumers seek ways to stretch their dining dollars further.

In conclusion, the rising cost of fast food is a multifaceted issue driven by supply chain disruptions, inflationary pressures, and evolving consumer preferences. While the days of dirt-cheap drive-thru meals may be a thing of the past, savvy consumers can still find ways to indulge in their favorite fast food treats without breaking the bank. However, it may require a bit more creativity and resourcefulness in navigating the ever-changing landscape of the fast food industry.