Immigration can contribute to economic growth by expanding the labor force, increasing productivity, and driving innovation. Immigrants often fill essential roles in industries experiencing labor shortages, helping to sustain and grow businesses. Where is the Economy Headed in 2024?

Consumer spending is a critical driver of economic growth, as it accounts for a significant portion of overall economic activity. When consumers feel confident about their financial situation and job prospects, they are more likely to spend on discretionary items, leading to increased demand and economic expansion. Where is the Economy Headed in 2024?

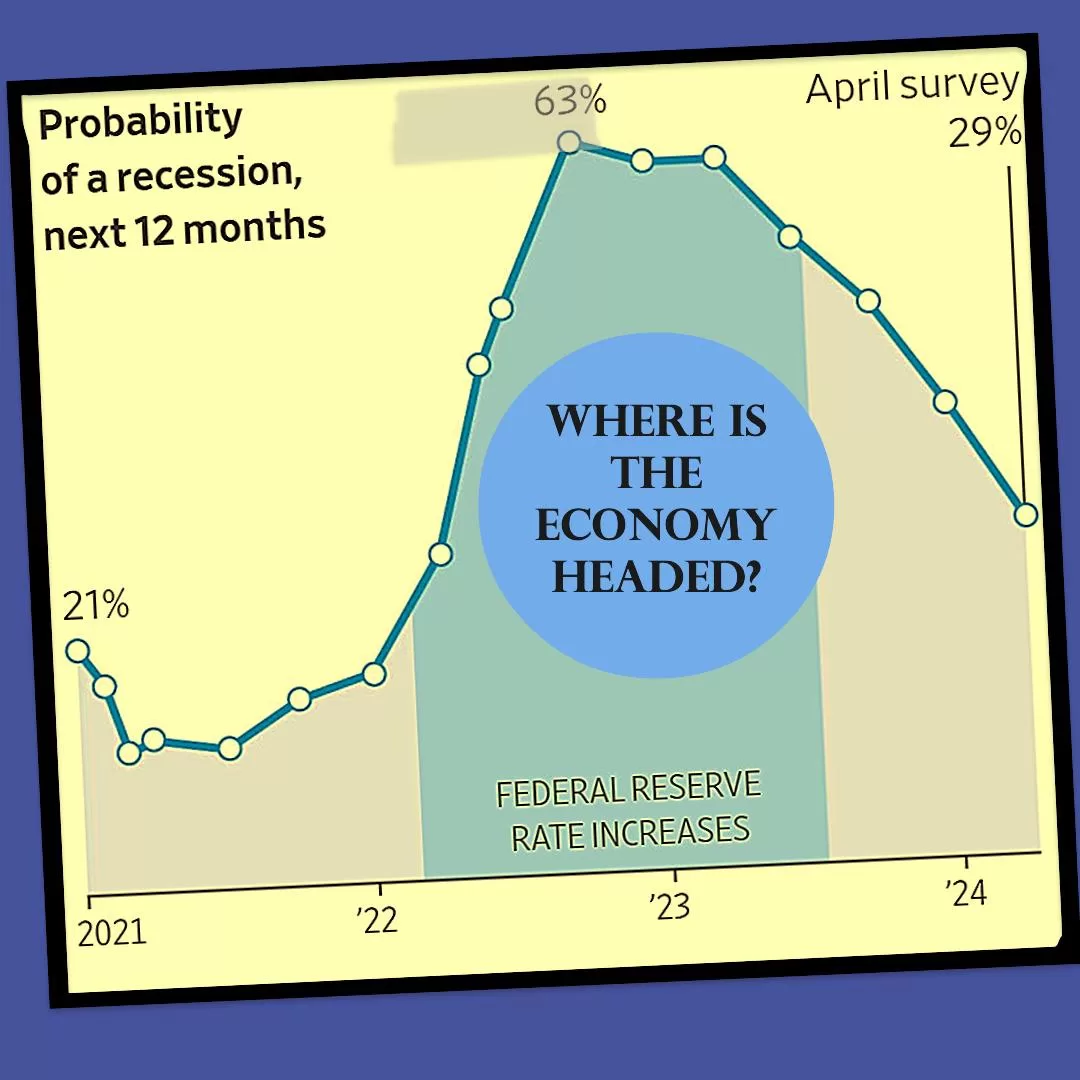

Given the robust growth fueled by these factors, economists are optimistic about the economy’s near-term outlook. Confidence in job security is likely bolstering consumer sentiment, encouraging continued spending and economic momentum. As a result, economists don’t foresee the economy entering a recession in the coming year.

It’s important to monitor various economic indicators and external factors to assess the sustainability of this growth trajectory and identify any potential risks or challenges that may arise in the future.

The job gains surpassing forecasts indicate a robust labor market, potentially buoyed by factors such as increased immigration contributing to population growth. A growing population can create additional demand for goods and services, which in turn stimulates job creation across various sectors of the economy.

However, economists’ anticipation of an imminent slowdown suggests that there are constraints on the labor market’s ability to sustain this rapid pace of job growth. One such constraint mentioned is the possibility that businesses are struggling to find available workers due to the tightening labor market. As the pool of unemployed or underemployed workers diminishes, it becomes increasingly challenging for businesses to fill job vacancies, which can hinder their ability to expand operations and meet growing demand.

When businesses face difficulties in hiring workers, it can lead to labor shortages, wage pressures, and potentially slower economic growth. Additionally, constraints on labor supply can prompt businesses to explore alternatives such as automation or outsourcing, which may have implications for employment levels and wage dynamics.

Overall, while the strong job gains reflect a healthy labor market and economic growth, the anticipation of a slowdown underscores the importance of monitoring labor market dynamics, workforce participation rates, and policies aimed at addressing labor market challenges to sustain long-term economic expansion.

Historically, economists and investors have been confident in the Fed’s ability to control inflation and maintain it around the 2% target. The focus has typically been on the strategies the Fed would employ to achieve this target rather than on doubts about its effectiveness.

However, recent developments suggest a departure from this confidence. Economists have begun revising their forecasts for inflation upward, indicating a growing acknowledgment of potential challenges in controlling inflation within the desired range. This adjustment in inflation forecasts occurred even before the release of recent data indicating higher-than-expected price levels.

The mention of “hotter-than-expected price data” suggests that inflationary pressures may be building more rapidly than previously anticipated. This unexpected surge in prices could prompt further revisions to inflation forecasts and raise questions about the Fed’s ability to rein in inflation effectively.

Overall, the passage highlights a shift in sentiment regarding inflation management, signaling increased uncertainty among economists and investors about the path ahead and the potential measures required to achieve the Fed’s inflation target.

For over two years, economists have been gradually increasing their forecasts for interest rates. This upward trend in interest rate forecasts has been driven by two main factors:

Despite concerns about slowing growth, the economy has demonstrated resilience, showing few signs of a significant slowdown. Strong economic growth typically leads to higher inflationary pressures, prompting expectations of tighter monetary policy by the Federal Reserve to prevent the economy from overheating.

Inflation has remained above the Fed’s 2% target for an extended period. Persistent inflationary pressures have raised concerns among economists about the potential for inflation to become entrenched, necessitating more aggressive monetary policy action by the Fed to bring it back to target levels.

However, there was a notable exception in January, where economists forecasted steeper rate cuts than in previous months. This deviation from the upward trend in interest rate forecasts occurred because economists were confident that inflation was nearing its target and that the Fed’s efforts to control inflation were succeeding.

Now, economists have reverted to expecting a higher path for interest rates. This shift suggests a renewed focus on the potential risks of inflation and the need for the Fed to tighten monetary policy to ensure price stability. It also reflects a reassessment of economic conditions and the outlook for growth, inflation, and interest rates in light of recent developments.

Connect with Factoring Specialist, Chris Lehnes on LinkedIn

Read more articles about the Economy